Soft Suave - Live Chat

1

1

Soft Suave - Live Chat

1

1

The Client is one of the first neo-banking companies based in the Philippines with branches in Singapore and India. They want to expand their service through a mobile application that sits on everyone's phone as a secured banking platform.

The brick-and-mortar Kind of bank is no longer necessary. The fully digital facility reduces transaction risks and time. The client aims to provide a secured banking service with interactive simplifications by augmenting this service to the mobile application.

The online banking service offers everything that has been done physically into a fully digital facility so that it simplifies all the risky tasks for both the bank and customers.

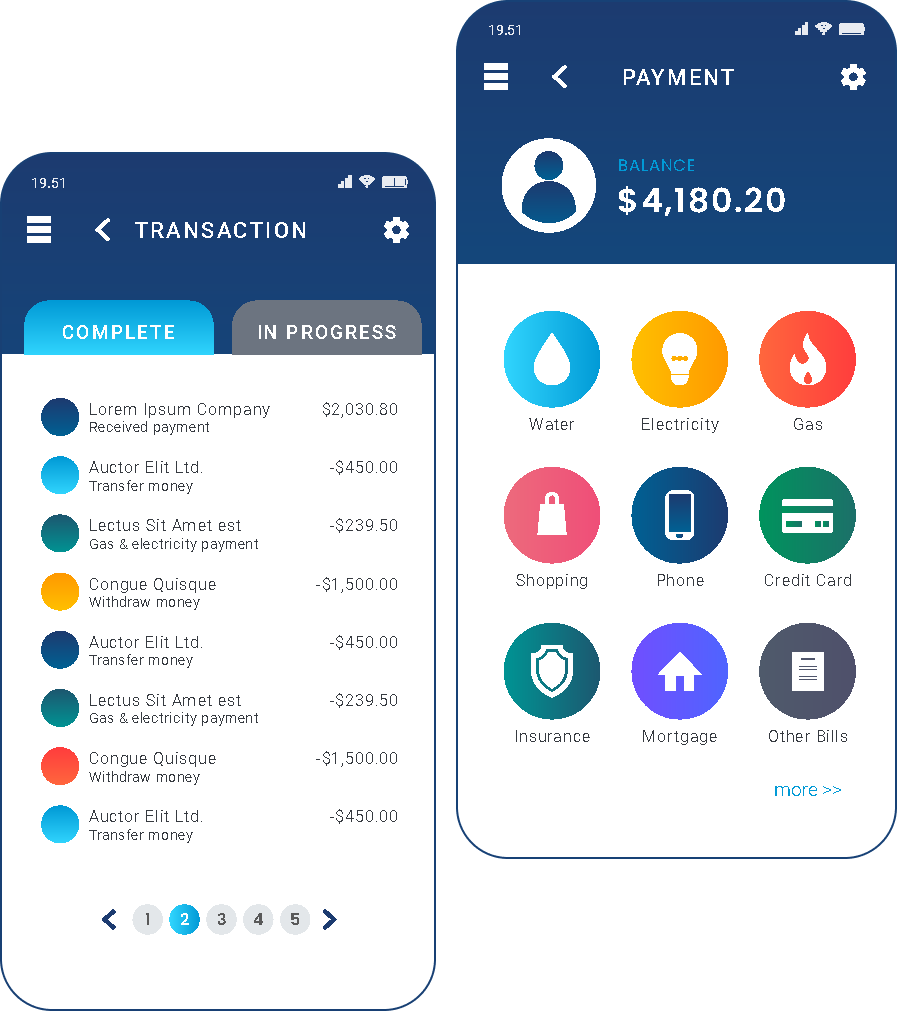

Using this app, you can access a variety of financial products, such as deposits, loans, savings accounts, payments, and cards, with High security. You can also interact and use offers and benefits with a smile on your face with the application as it fulfills all your financial needs. It has engaging UX/UI features and is featurerich.

Our client is a philippine based banking investor who had a vision of developing the first neo banking application in central Asia. Choosing us as their trusted partner, They met us with the primary requirements as follows.

Building a Mobile application for a Neo Bank carries lots of challenges. As a first phase, we started to list out the challenges so we can solve them for the client’s app. Figuring this out also helps us understand more about the Banking application’s market needs and how to make it unique by adding new features.

The more a trend is followed, the more it gets outdated and flawed. Wanting for the new features also gets increased. For a banking application, Speed, simplification, and flexibility in transactions are very important.

The more a trend is followed, the more it gets outdated and flawed. Wanting for the new features also gets increased. For a banking application, Speed, simplification, and flexibility in transactions are very important.

Security is one of the major concerns for customers to trust online banking because of the frequent cyber attacks in recent years.

When the Covid -19 outbreak happened, the pandemic situation led to direct banking transactions. That's when neo-banking was there to help people with all types of financial support.

People may just leave the application if the registration process itself is a complicated and confusing one. So, Simplifying particularly these portions is one important thing to consider.

Every fintech app faces compliance challenges. Getting it right is generally time-consuming, confusing, and expensive. Many countries do not have a single fintech-centric regulation that app developers must follow.

When the challenges are found, we have to fulfill them with adequate features and flexible usage. The appearance of the app is also equally important.

The neo banking mobile application features are different from a physical bank’s app. Because they offer different services, these kinds of banks mostly rely on fully online and instant simplified banking. That's how this app is designed for its needs.

These are personal stashes. The user can choose their saving goals fully under their control. A user can have a maximum of 5 stashes either group or solo.

Group stashes are social ways to save money. It also allows users to invite friends and family to join a group stash so that they can contribute to whatever they're saving up for.

The time deposit is similar to a savings account but earns a much higher interest the longer you keep it with us.

The simplicity of this feature and the minimal documentation requirements make it more appealing. Just select the loan type — authorize your face ID — upload your ID card — verify it. Here are the various loan options.

Fast approval and real-time disbursement to your tonic account.

Loan amounts from 5000 to 50,000 peso

Minimal documents required - only 1 valid ID and 1-month payslip.

Flexible payments date - your preferred salary payout date.

6, 9, 12, 18, or 24 months installment.

100% digital - all loan info can be seen on the app.

One bank account for application and cash disbursement.

The fixed monthly interest rate of 7% Enjoy a lover monthly interest rate of 5.42% when you link your salary payroll ATM card.

Top up your main account. Get autodebited on your due date.

Once the lender accepts a borrower's application, they can receive a lump sum amount. In EMI installments, they repay the loan over a set period of time.

Quick loans are typically unsecured loans, the user doesn’t need to pledge any collateral to secure the loan. The application process can be accomplished in minutes. The users can avail of up to 50,000 pesos.

The loan is secured by the property. An asset pledged as collateral secures the loan. An asset can either be land, a house, or commercial property. Until the entire loan against the property is repaid, the asset remains the lender's collateral.

It's a new loan scheme to suit the financial needs of customers who purchase products from commercial shops. It’s a reliable loan for the big purchases you deserve.

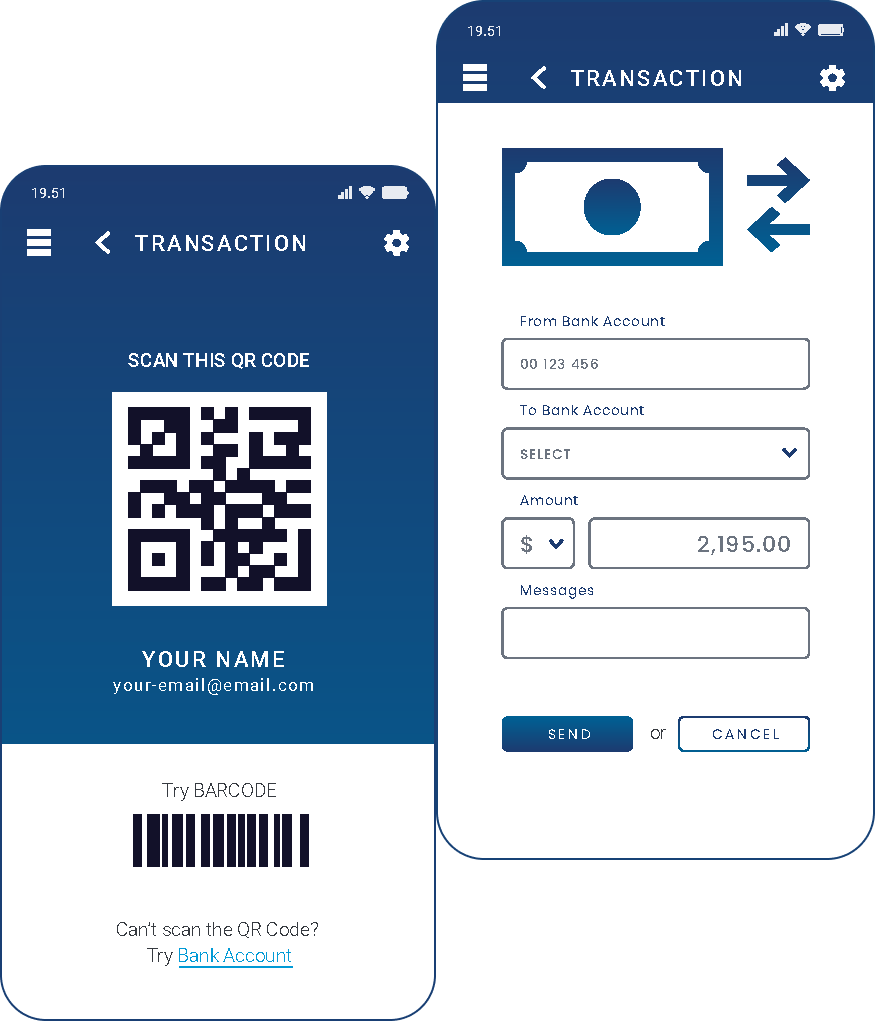

Having a wallet brings out lots of benefits. The money transfer and miscellaneous payments are done instantly.

Our goal is to make the application a highly secure, risk-free, and time-saving digital application. By adding new and unique features to the app, becoming a helpful banking app for customers and clients, and achieving marketing goals, Soft Suave achieved its goal.

The application came out with great outcomes and achieved business goals also by gaining millions of users and 4.8 ratings in the Google play store from customers all around the world. The clients are satisfied and the customers are benefited from the product made by Soft Suave.

Are you ready to revolutionize digital banking with next-level security? Dive into our case study and discover how to make it happen!